Chromite Ore Pricing: Factors that Influence Market Value

Introduction: Chromite Ore Pricing

Chromite ore is the primary source of chromium, which is a super vital element used in a plethora of industries, from metallurgy and refractory to chemicals and pigments. Think of your sleek stainless-steel kitchen appliances or the sturdy alloys in aerospace—thank chromium for that shine and strength!

The world today practically thrives on technologies and industries that owe their very existence to this precious ore. That’s why understanding what factors impact chromite ore pricing and its trends are vital. Every dip and surge in its price impacts industries and, in turn, affects our day-to-day lives.

Imagine this – you’re constructing a building. Would you not want to know the price and quality of the bricks you’re using? Similarly, for those delving into the world of minerals and metallurgy, comprehending chromite ore’s market value becomes quintessential.

As Iranchromite dives deeper into this subject, you’ll get a clearer idea of why this dark, shiny mineral has taken the world by storm.

Overview Of The Chrome Industry

Chromite Ore Usage

In the year 1798, the world first witnessed the isolation of chromium as a distinct metal. However, it took another two decades – until 1818, to be precise – before this vibrant metal found its way into the everyday wallpaper pigments. Fast forward to the 20th century, with the booming global steel scene, chromium’s role became paramount as an indispensable alloy partner.

Let’s take a glance at how chromium is primarily utilized:

Metallurgy: 91%

Chemicals: 5.5%

Bricks and Casting Sand: 3.5%

Chromium’s charm in metallurgy stems from its knack for gifting attributes like corrosion resistance, robustness, strength, and a dazzling finish. This is precisely why ores of a metallurgical grade transform into ferrochrome, a critical ingredient for crafting corrosion-resistant, heat-enduring, and gleaming stainless steel. And here’s a fun fact: when it comes to stainless steel, or the high-priority superalloys, nothing can replace chromium. Yet, for other metallurgical endeavors, chromium-rich scrap often steps in as a worthy stand-in for ferrochrome.

Swinging over to the chemical realm, chromium showcases its versatility. Through chemical processes, the ore morphs into solutions and then to dichromate, which becomes the backbone of vibrant colorants, wood protectants, leather enhancers, and the gleam of chromium plating.

Lastly, let’s touch upon bricks and casting sand. For those furnace linings that need refractory bricks, it’s essential that the ore has minimal silica and a consistent texture, a signature trait of the chrome ore concentrate from South Africa. And for casting? Chrome foundry sand, with its specialized and meticulous grading, shines as the go-to choice for steel casts and various other foundry tasks.

World Chrome Ore Reserves

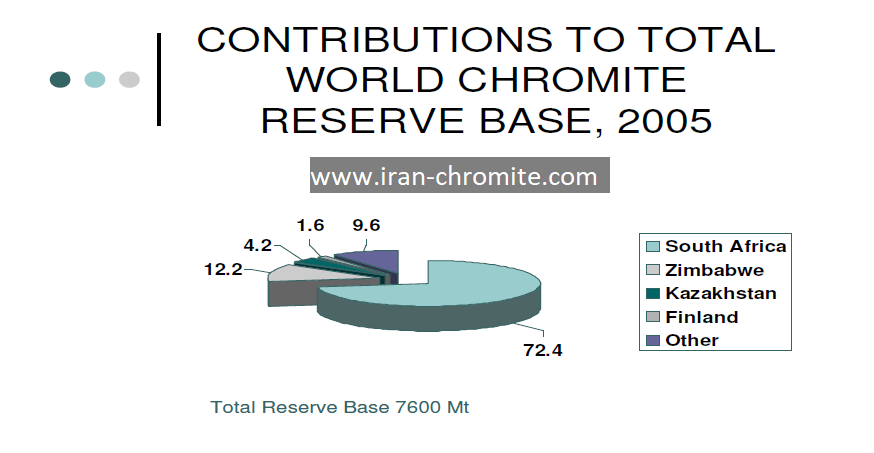

The World’s largest chrome ore reserve base (6403 Mt) is located in the Southern African region and is associated with the Bushveld Complex and the Great DWorld Chrome Ore Reserves, Zimbabwe.

Perched at a majestic 5,550 Mt, South Africa proudly claims 72.4% of the planet’s chrome ore riches. However, there’s an interesting twist. It only contributes 38.3% to the world’s chrome ore production and holds a 15.4% slice of the global export pie (as shown in Table1). Why the lower export numbers, you ask? South Africa focuses on refining and enhancing the ore, leading to a larger export of value-added items, mainly ferrochrome. The majority of their chrome ore doesn’t even leave the country: in 2005, 90% catered to local demands, positioning South Africa fourth in global chrome ore exports.

World Chrome Ore Reserves, Production and Sales

COUNTRY | RESERVES (Mt) | % | Rank | PRODUCTION (kt) | % | Rank | EXPORTS (kt) | % | Rank |

South Africa | 6,050 | 79.6 | 1 | 8,243.4 | 42.1 | 1 | 722.7 | 16.9 | 4 |

Kazakhstan | 352 | 4.6 | 3 | 3,939.1 | 20.4 | 2 | 1,012 | 23.8 | 2 |

India | 73.7 | 1.0 | 5 | 3,580.5 | 18.2 | 3 | 1,134.1 | 26.6 | 1 |

Turkey | 22 | 0.3 | 6 | 944.9 | 4.9 | 4 | 792 | 18.6 | 3 |

Zimbabwe | 1,023 | 13.4 | 2 | 902 | 4.7 | 5 | 0 | 0 | – |

Russia | w | w | – | 849.2 | 4.4 | 6 | 0 | 0 | – |

Brazil | 18.7 | 0.2 | 7 | 744.7 | 3.9 | 7 | 126.5 | 3.0 | 6 |

Finland | 132 | 1.8 | 4 | 628.1 | 3.3 | 8 | 0 | 0 | – |

Australia | w | w | – | 266.2 | 1.4 | 9 | 224.4 | 5.3 | 5 |

Iran | w | w | – | 246.4 | 1.3 | 10 | 246.4 | 5.8 | 4 |

Other | 688.6 | 9.0 | – | 897.6 | 4.8 | 429 | 10.0 | – |

|

TOTAL | 8,360 | 110 |

| 21,242.1 | 110 |

| 4,687.1 | 110 |

|

South African Chrome Ore Reserves:

The Bushveld Complex, a vast, oval-shaped geological wonder sprawled across provinces like Northwest, Gauteng, Mpumalanga, and Limpopo, cradles an abundance of chrome ore, essential for forging chromium and its various alloys. Spanning a massive 300km from east to west and 100km from north to south, the complex, with its layers of igneous rock strata, gently cascades toward its heart. Five distinct belts or limbs make up the Bushveld, and chrome extraction primarily focuses on the eastern and western limbs. It’s the mafic to ultramafic rocks, products of unique crystallization patterns from cooling magma, that host the stratiform chrome ore reefs. A hallmark of these reefs is their striking consistency, maintaining both grade and thickness over an impressive 200km stretch and even plunging to depths surpassing 1km. In South Africa, chrome ores fall into two categories based on their chromium concentration: those with less than 44% and those between 44-48%. However, it’s noteworthy that the chromium grades of South African ores tend to be on the lower end when juxtaposed with global counterparts.

Chromite Ore Trade and Export/Import Dynamics:

In the grand arena of global chrome ore consumption, China stands tall as the primary aficionado, primarily sourcing from heavyweights like South Africa, Kazakhstan, and India. But here’s the twist: China’s reliance on this trade is on a see-saw. The nation’s move towards curbing high-emission and energy-guzzling sectors suggests a potential dip in chrome ore imports. Now, toss in the latest strategy: China, already a burgeoning powerhouse in stainless steel production, has slashed ferrochrome import duties from 2% to a mere 1%. This could be the golden ticket for surging ferrochrome exports to the Chinese shores. Meanwhile, over in India, the top dog in ore exports, there’s been a strategic pivot. A hefty 45% tax on chrome ore exports means China might need to look harder and wider for its feedstock.

Historical Perspective on Chromite Ore Pricing

Major historical events affecting production:

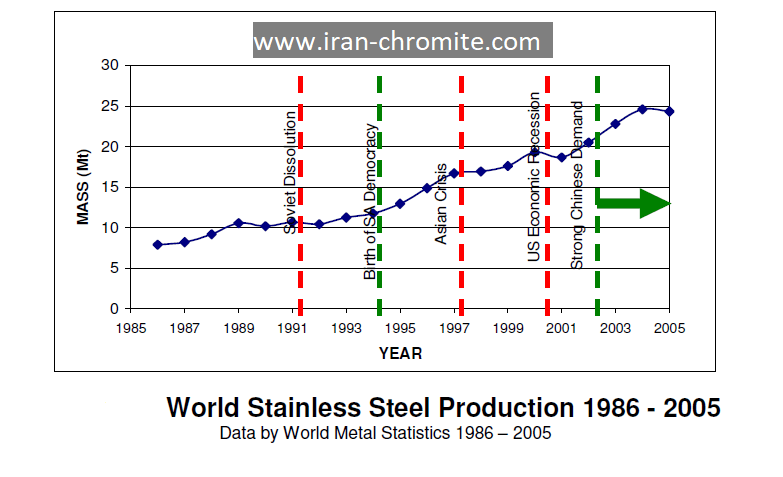

With stainless steel reigning as the primary consumer of chrome ore, the global production trends of stainless steel become pivotal in dictating the demand for chromium. This, in turn, casts a shadow on chrome ore production dynamics and its pricing patterns. It’s a classic game of balance: when the clamor surpasses what’s available, prices naturally soar. Conversely, when the scales tip the other way, prices drop. An imbalance, like a deficit, usually prompts an overdrive in production, aiming to recalibrate the market’s balance.

Over the past two decades, the chrome ore and ferrochrome market has danced to the rhythm of five pivotal moments, as illustrated in Figure below:

- a) 1991 saw the grand curtain fall on the former Soviet Union (FSU), now recognized as the CIS. This monumental shift led to a dip in chromium cravings from these territories.

- b) South Africa’s embrace of democracy beckoned global investors to its mining industry, notably by the mid-1990s.

- c) The tremors of the 1997 Asian crisis echoed worldwide, as the global stainless steel appetite dwindled, subsequently affecting ferrochrome demand and chromium output.

- d) The year 2000 saw the US economy stumble, mirroring the repercussions of the ’97 Asian meltdown.

- e) From 2001 and beyond, China’s insatiable hunger for chrome ore and ferrochrome took center stage, fueled by its soaring stainless steel manufacturing prowess.

The Chromite Ore Recent Market’s Fresh Landscape

2021 proved to be a year of reawakening in the chromite industry. Glencore made waves when they voiced their intention to breathe life back into the Mutanda mine, nestled in the heart of the Democratic Republic of Congo. But it’s not just copper and cobalt this mine is known for; it’s a veritable powerhouse of chrome ore, and its resurgence could spell big changes for the global chrome ore scene.

Meanwhile, ERG wasn’t just sitting around. They penned a solid five-year deal with China’s renowned Tsingshan Holding Group. With this deal, a whopping 600,000 tonnes of chrome concentrate will find its way to China every year. It’s not just a supply contract; it’s a beacon of stability in an otherwise volatile market and could turn the tides for ERG’s offerings.

Down in South Africa, Hernic Ferrochrome showcased resilience. Battling financial storms due to dipping chrome ore prices, they’ve emerged, phoenix-like, from their business woes. A commendable restructuring later, they’re back, and they mean business.

What’s Trending in Chromite Ore

When we talk about trends, the chromite ore industry is no stranger to evolution. Stainless steel is the new black. Finding its way into everything from industrial chemicals to your favorite gadgets, and even the behemoths that transport us, it’s the trendsetter in the chromite ore narrative. Add to that the rising star that is ferrochrome, blending chromium and iron, becoming indispensable in steel production. And let’s not forget the sheer charm of stainless steel — durable, fuss-free, and a friend to Mother Earth — it’s the chosen one for vehicles, trains, and more.

Quality Variations and Pricing of Chrome Ore

Different grades of Chromite Ore

You see, not all chromite is created equal. There are different grades, each with its unique composition and properties. In the chromite world, you have metallurgical grade, refractory grade, and chemical grade. Metallurgical grade, my favorite to work with, is primarily used in the production of ferrochrome for the steel industry. It’s the top-tier stuff. The refractory grade has a high melting point, making it perfect for lining furnaces and molds. And last but not least, the chemical grade, used for – you guessed it – various chemical processes.

How quality affects market value

The purer the ore, the heftier the price tag. It’s as simple as that! Well, higher-quality ore means less impurities, easier smelting processes, and a better end product – be it in steel or chemicals. Lesser grades might sell for less, but remember, they still have their niche. In the table below, you can compare different grades of chromite ore supplied from different zones. (October 2023)

Conclusion: Chromite Ore Pricing

Chromite ore, as the cornerstone of chromium, holds paramount significance in various industries, with its value reflecting its myriad applications – from metallurgy to chemicals. As the world has evolved, so has the demand for this precious mineral. The dynamics of chromite ore pricing are intertwined with global trends, geopolitical shifts, quality gradations, and strategic trade maneuvers. It’s evident that global chrome reserves, historical events, trade dynamics, and quality variations intricately shape its market value. The ever-changing global landscape further underscores the necessity for stakeholders to remain vigilant, adaptive, and informed to harness the potential and challenges presented by the chromite industry.